PM Vishwakarma Loan - Apply Online

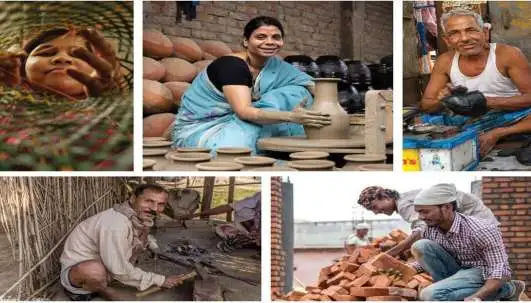

PM Vishwakarma Loan: The PM Vishwakarma Scheme aims to bolster the skills and entrepreneurial capabilities of traditional artisans and craftspeople. Under this initiative, beneficiaries will gain access to affordable credit facilities, empowering them to thrive in their respective crafts. However, to be eligible for the first tranche of credit support up to Rs. 1 lakh, individuals must undergo a Skill Assessment and complete Basic Training.

इस आर्टिकल को हिंदी में पढ़ने के लिए यहां क्लिक करें।

This component’s primary objective is to equip the Vishwakarma community with easy access to subsidized institutional credit for enterprise development through the following interventions:

PM Vishwakarma Loan Eligibility

The following Eligibility criteria have been set by the govt of India to receive PM Vishwakarma Loan from the relevant financial institutions in India.

- The applicant should be an Indian resident.

- The applicant should be an Artisan or Craftspeople/Craftsmen.

- Minimum Age should be 18 years or above

- Applicant should not have availed the benefits of PMEGP, PM SVANidhi or Mudra Loan

Artisans or Craftsmen engaged in any of the below-mentioned trades are eligible to get benefits under the PM VISHWAKARMA.

- Carpenter (Suthar/Badhai)

- Boat Maker

- Armourer

- Blacksmith (Lohar)

- Hammer and Tool Kit Maker

- Locksmith

- Sculptor (Moortikar, Stone Carver), Stone Breaker

- Goldsmith (Sunar)

- Potter (Kumhaar)

- Cobbler(Charmakar)/ Shoesmith/ Footwear Artisan)

- Masons (Raaj Mistri)

- Basket/ Mat/ Broom Maker/ Coir Weaver

- Doll & Toy Maker (Traditional)

- Barber (Naai)

- Garland Maker (Malakaar)

- Washerman (Dhobi)

- Tailor (Darzi)

- Fishing Net Maker.

PM Vishwakarma Loan Required Documents

You need to present the below-mentioned documents to receive loans from the relevant banking institutions:

- Aadhar Card

- Voter ID Card

- PAN Number (Optional)

- Mobile Number

- Proof of occupation

- PM Vishwakarma’s training Certificate which is provided by the National Skill Qualification Framework (NSQF).

- PM Vishwakarma Digital Certificate

- PM Vishwakarma ID Card

- Caste Certificate (If applicable)

PM Vishwakarma Enterprise Development Loan

PM Vishwakarma Loan for Enterprise Development: A cornerstone of the PM Vishwakarma scheme is the provision of collateral-free ‘Enterprise Development Loans’ to targeted beneficiaries. This financial support aims to bolster their entrepreneurial endeavours within the realm of traditional crafts.

The total loan assistance available under this component amounts to Rs. 3,00,000/-. Beneficiaries can access this assistance in two tranches:

1) First Loan Tranche: Eligible beneficiaries can avail of up to Rs. 1,00,000/- as an initial capital injection.

2) Second Loan Tranche: Upon successful utilization of the first tranche, beneficiaries can secure an additional loan of up to Rs. 2,00,000/- to further expand their enterprises.

This two-phased approach ensures a structured and sustainable flow of funds, enabling artisans and craftspeople to establish and grow their businesses while preserving the rich heritage of traditional craftsmanship.

The disbursement of credit under the PM Vishwakarma Scheme is intricately linked to the attainment of specific training milestones. To become eligible for the first loan tranche, beneficiaries must successfully complete a 5-7 day Basic Training program provided by the Ministry of Skill Development and Entrepreneurship (MSDE).

Subsequent to availing of the first tranche, beneficiaries can qualify for the second loan tranche by meeting certain criteria. They must have maintained a standard loan account for the first tranche, adopted digital transactions in their business operations, or undergone Advanced Training. Additionally, they are required to have repaid the entire first loan tranche before becoming eligible for the second tranche.

The repayment structure for these loans is designed to be convenient, with beneficiaries required to make monthly instalments. The specific repayment term varies and is outlined in Table 2.

This structured approach ensures that the beneficiaries receive financial support in tandem with skill development, fostering a conducive environment for the growth and sustainability of their enterprises.

| Tranche | Amount of Loan | Term of Repayment |

|---|---|---|

| 1st Tranche | up to Rs. 1 Lakh | up to 18 months |

| 2nd Trance | up to Rs. 2 Lakh | up to 30 months |

PM Vishwakarma Loan Concessional Interest and Interest Subvention

- Beneficiaries will pay a low-interest rate of only 5% on the loans they receive. The Government of India will provide substantial support by subsidizing an additional 8% of the interest upfront to the banks. This means the total interest charged by banks will be 13%, but beneficiaries only pay 5%. Annexure A shows this calculation clearly.

- This subsidized 5% interest rate applies to both the first and second loan tranches that beneficiaries can receive.

- The Credit Oversight Committee led by the Secretary of the Department of Financial Services has the authority to revise the 8% government subsidy cap if needed, based on prevailing interest rates in the future.

In simple terms, the scheme offers loans at very low 5% interest rates to beneficiaries thanks to an 8% interest subsidy provided by the government upfront to banks. This subsidy can be adjusted by the oversight committee as per market conditions.

PM Vishwakarma Loan Guarantee

To provide security and reduce risk for the lending institutions, all loans sanctioned under this scheme will be covered by a graded guarantee from the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE). This guarantee will be applied on a portfolio basis.

Portfolio Creation

The loan portfolio will be created annually, with each portfolio covering loans given out during the financial year. The guaranteed coverage will be subject to the following conditions:

First Loan Tranche Guarantee:

- For defaults between 0 to 7.5% of the portfolio, there will be 100% coverage by the guarantee.

- For defaults between 7.5% and 20% of the portfolio, 80% of the defaulted amount will be covered.

- For defaults between 20% and 50% of the portfolio, 60% of the defaulted amount will be covered.

The maximum guarantee coverage for the first loan tranche portfolio will be 50% of the total portfolio value for that year.

Second Loan Tranche Guarantee:

- For defaults up to 5% of the portfolio, there will be 100% coverage by the guarantee.

- For defaults between 5% and 15% of the portfolio, 80% of the defaulted amount will be covered.

The maximum guarantee coverage for the second loan tranche portfolio will be 15% of the total portfolio value for that year.

Table 3 provides a clear breakdown of these coverage details.

The CGTMSE will provide a graded guarantee to cover a portion of loan defaults in each yearly portfolio. This guarantee acts as a safety net for lenders, encouraging them to provide loans under this scheme without excessive risk.

| Dataset | First Loan Tranche | Second Loan Tranche | ||

|---|---|---|---|---|

| Portfolio | Coverage | Portfolio | Coverage | |

| First Loss | 0 to 7.5% | 100% | 0 to 5% | 100% |

| Second Loss | Above 7.5% to 20% | 80% | Above 5% to 15% | 80% |

| Third Loss | Above 20% to 50% | 60% | ||

| Maximum Guarantee Cover | 50% | 15% | ||

| Effective Guarantee Cover | 35.5% | 13% |

PM Vishwakarma Loan: Where to get the loan? (Participating Financial Institutions)

A wide range of financial institutions can provide loans under this scheme. These include:

- Scheduled Commercial Banks

- Regional Rural Banks

- Small Finance Banks

- Cooperative Banks

- Non-Banking Finance Companies

- Micro Finance Institutions

All these lenders are allowed to give out loans to beneficiaries under the rules of this program.

To make sure the scheme benefits as many people as possible across different regions, the lending institutions will be encouraged to use their field staff and local representatives, known as Business Correspondents or Associates.

By utilizing their networks of local field workers, the lenders can expand the coverage of this scheme and make the loan facilities accessible even in remote areas where beneficiaries may be located.

Many types of banks and financial firms can lend under this scheme. To reach more beneficiaries, even in faraway places, the lenders will send their local field staff to spread awareness and facilitate loans.

PM Vishwakarma Loan Objectives

- To enable the recognition of artisans and craftspeople as Vishwakarma.

- To provide skill upgradation opportunities.

- To support the acquisition of better and modern tools.

- To offer the intended beneficiaries easy access to collateral-free credit.

- To incentivize digital transactions.

- To provide a platform for brand promotion and market linkage.

PM Vishwakarma Loan Features

- The program offers two loan tranches: Rs. 1,00,000/- at 5% interest rate in the 1st tranche, repayable in 18 months, and Rs. 2,00,000/- at 5% interest rate in the 2nd tranche, repayable in 30 months.

- Skill training will be provided by government-nominated training centers.

- Each beneficiary will receive a training stipend of Rs. 500/- per day while undergoing basic and advanced training.

- A toolkit incentive of Rs. 15,000/- will be provided to procure an improved tool kit after skill verification at the start of basic training by the nominated training center.

- Beneficiaries will be provided with a PM Vishwakarma Certificate and ID card by the government upon completion of training.

- An incentive of Rs. 1/- will be given for every digital transaction made by the beneficiaries.